Divide this text into sentences and correct mistakes: No one will hear my voice. Bonnie step hasn't seen a scent of her child support payments in months, so she staged her own protest to try and get the $2,300 she's owed. "How much are you depending on that money?" "I'm broke and don't blame her ex-husband, Richard. He's been paying $342 dollars every two weeks, and that poor woman, she needs the money. My daughter needs the money. Both parents call this a case of deadbeat dor." The Florida Department of Revenue is taking the money, so why isn't Bonnie getting paid? The state's not supposed to be a bank. "I mean, if this hand doesn't know that this hand's doing, the problem started in December when the couple's daughter, Mackenzie, turned 18. The state closed her account, but Step has a court order to pay child support until she graduates from high school in May. He took his paperwork in and was told the case had been reopened." Weeks go by, it's not taken care of. "Nothing. I called dor. This time he gets a different person and a different answer." She goes, "What was under review? What does that mean? I don't know." The cycle continued for three months until bonny came out with her signs. Within 15 minutes, 2 reps from the DOR came to talk to her, but they didn't want our camera there. They will ask you a few questions. When you come back out, clear. But they didn't come back out. Instead, they called Bonnie's cell phone letting her know the problem is fixed. "Am I gonna get the lump sum deposited tomorrow by midnight? Interesting how that happens." In the past few months, 8 on your side has received dozens of emails and calls...

Award-winning PDF software

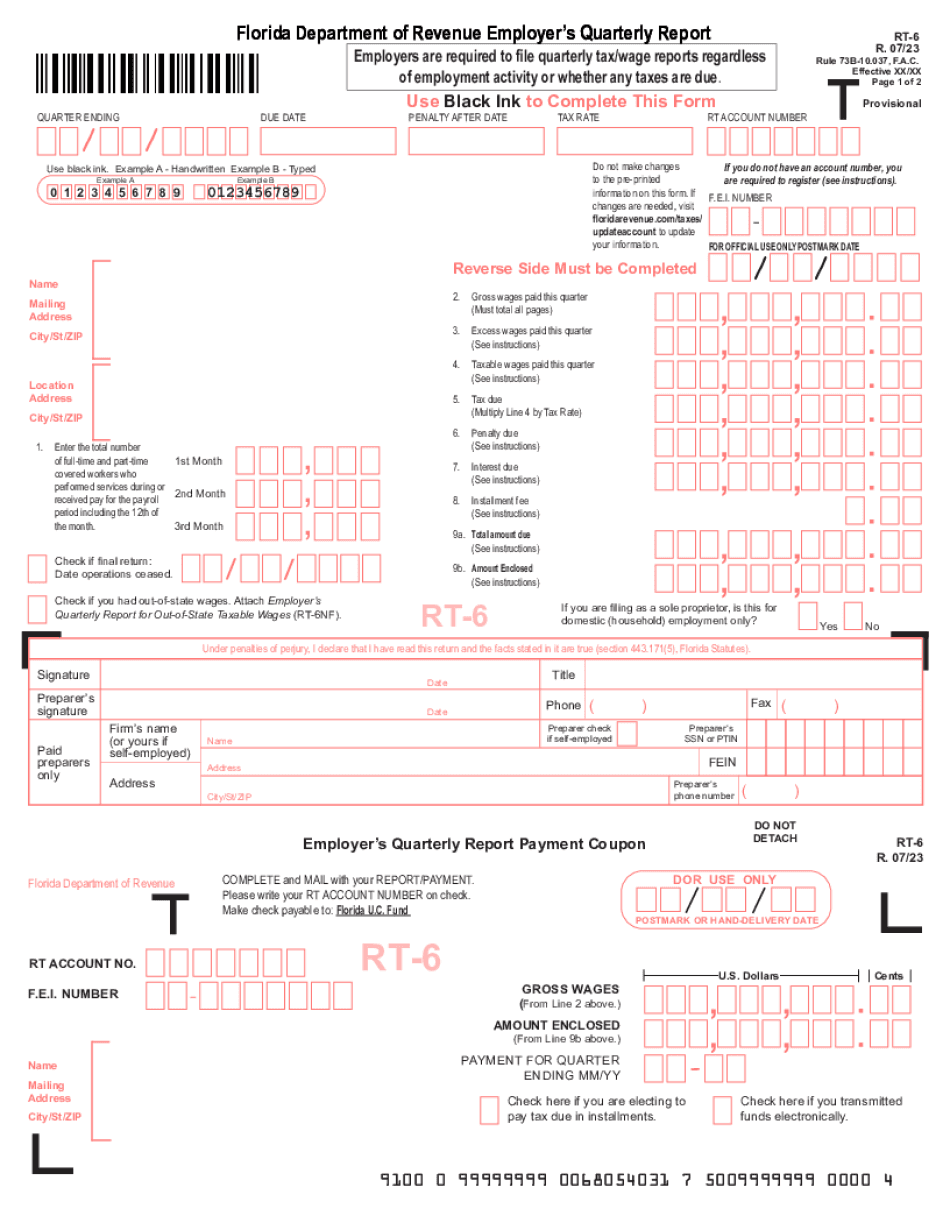

Florida rt-6 fillable Form: What You Should Know

State employees' rate of payment for Florida's unemployment tax has been changed to: 9.75 per hour for a salaried employee, or the equivalent in federal dollars for a nonexempt non-service employee; 9.70 per hour for an employee who works less than 40 hours per week for a salaried employee, or the equivalent in federal dollars for a nonexempt non-service employee; 10.80 per hour for an employee who works 40 hours per week for a salaried employee, or the equivalent in federal dollars for a nonexempt non-service employee. The Florida Unemployment Insurance Commission (FCC) has released a new form for employers to file the Florida Unemployment Exemption Application (FACE) on behalf of Florida unemployment insurance recipients using the new Form 50-1 for Florida Individual Unemployment Insurance (FIP), Form 50-2 for Florida State Unemployment Insurance (FSU), and Form 50-3 for Florida Federal Unemployment Insurance (FUJI). The purpose of the FACE form is to reduce the number of requests that a claimant submits and to reduce processing times. To obtain an FACE, click here to download the form in PDF format. The new Form 50-1-1 must be completed and submitted by both the claimant and the employer. The Form 50-1-1 can be completed and submitted online using the “Online Form” at this link. The form must be completed on-time in order to receive benefits for a particular month of benefits. FCC also has a form you can download in PDF format for a claim for Florida Unemployment Exemption Application (FACE), or complete and submit to the Florida Unemployment Insurance Commission at this link. The fee to use this form is 20. Note: The information and links in this post are general information only. Information on calculating and reporting unemployment tax and benefits is subject to change at any time. For the latest information, contact the State Employment Security Department or the Florida Department of Revenue. Florida Employment Tax — FAQs and General Information How is unemployment compensation calculated? Unemployment compensation is calculated by dividing the total number of hours worked for compensation by a claimant's total earnings during the payment period. The claimant is liable for the entire unemployment insurance tax, as a nonexempt employee. Does this mean I should hire temporary workers to fill jobs during my regular work week? Not necessarily.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FL DoR RT-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any FL DoR RT-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FL DoR RT-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FL DoR RT-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida rt-6 fillable form