Corner corner also following breaking news on an issue we have been fighting for you for months. Unemployment benefits. The US Department of Labor has given the Florida Department of Economic Opportunity permission to temporarily give delayed unemployment benefits to thousands of you. For near corner has worked tires tirelessly and relentlessly for months, taking your concerns to legislators. As the state's new 63 million dollar website made it nearly impossible for some of you to get your money. In the last three months, John Gaunt's has been evicted. Management companies don't want to hear no excuses. In the last three months, Ricky Lucky has lost his life savings. "Falling behind on all my bills, my savings account has been wiped out," he says. And in the last three months, Ricky Freeman, "I know the mine is dead, but I just don't know what's the whole love," Tim Fulcher. "It's just like you hitting your head up against the wall," and Marissa Hale are out hundreds of dollars. "It's not fair because everybody in the governor's office, everybody at unemployment, they're eating good at night, they're sleeping well, they're not worried about bills," she adds. There are thousands of others too. After the state launched a new 63 million dollar unemployment website that left many with long wait times, disqualified notices, locked accounts, and no one to talk to. We've pressed the governor. Hundreds of thousands of claims that have worked so the, and they continue to fix it so it's headed in the right direction. Well, but you know, we also have the call center you can call in. The truth is, hundreds of thousand claims have worked. And now, after fighting day in and day out for answers for you, it appears relief is on the way. Friday,...

Award-winning PDF software

Florida reemployment login Form: What You Should Know

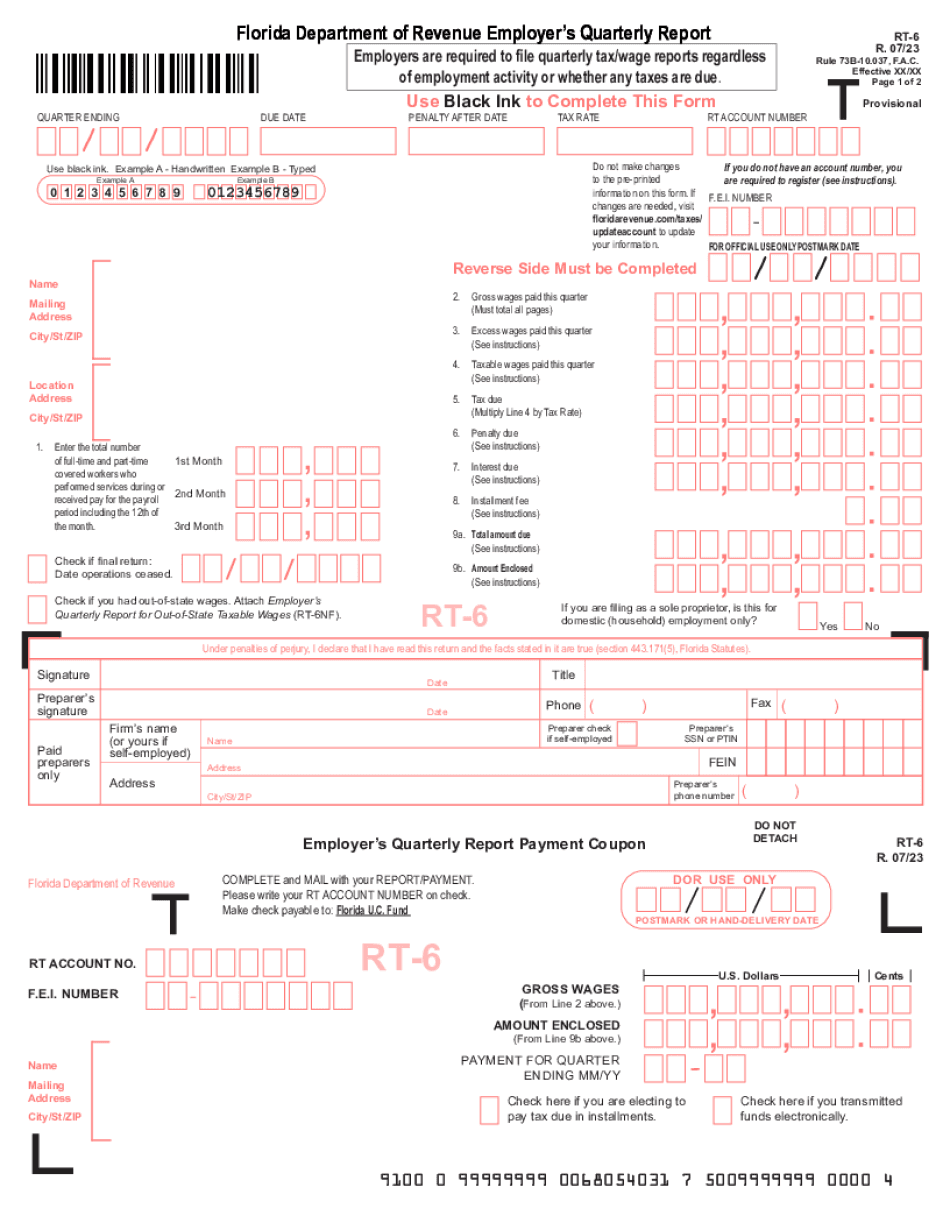

You cannot be approved without this information. Florida Reemployment Tax — Florida Department of Revenue Reemployment Tax (RT) claims must be submitted by: January 31 and each calendar year for tax returns for the calendar year Reemployment Tax — Florida Dept. of Revenue (RT) Claim and Return Review Process All Reemployment Tax returns must be filed for processing by January 31 and received by the Department of Revenue by June 15. All Reemployment Tax returns are due for review and assessment on or before June 15 of each year. A late filing is subject to the standard penalty and interest rates of 10% per month. If you are the subject of an RT Tax payment Reimbursement for Reemployment Tax (RT), call and request an RT Payment Review (PRR) by contacting a Florida Department of Reemployment [Recovery] Division office within 15 business days of the tax filing date. For more information on Reimbursement for Reemployment Tax (RT), call (844) 5 85 6010 and select option 2. For questions please contact: Florida Division of Reemployment [Recovery] For further information please visit: for more information on our program and how our programs work FOR MORE INFORMATION: A. Click here or choose a menu item from the menu bar, on the left. B. Click on “File Your Claims Online” C. Type in your account information and follow the to get started. NOTE: To view any benefits or apply for any Reemployment Tax, and to find your information, go to your claimant's record and select one of the following items: 1. Complete Claims and Attachments to complete claims: Claimant Information (Claim Information Section), including name and Social Security Number(s); 2. Add a witness (If claimant did not file a claim); 3. Attach any documents you have, including W-2 information; 4. If claimant is reemployed, complete Information on Reemployment Tax (Including information regarding benefits and the status of those benefits). 5. Complete the IR-1, IR-2, and IR-3 forms (If claimant has no earnings from wages to include an explanation of that fact; 6.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FL DoR RT-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any FL DoR RT-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FL DoR RT-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FL DoR RT-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida reemployment login