Award-winning PDF software

Florida dr 835 fillable Form: What You Should Know

Request Your Military Service Records (including DD214, Military Personnel File) | National Archives Aug 29, 2025 — All veterans eligible for benefits should complete the Military Personnel File (MM) request form and submit it to the nearest National Archives site. The file, or records, need to show where the veteran was employed, when he/she was on active military assignment, and what duties he/she fulfilled. What Military Personnel File Need to Show National Archives — Office of the Assistant Chief of Counsel, Department of the Army (DIAS) Aug 22, 2025 — The records will be processed if they are on the correct forms and are not damaged or mutilated. Request Military Service Records | National Archives Aug 29, 2025 — The first request for a Military Personnel File was made on November 19, 1942. The form was changed slightly on September 30, 1952. Military records are required to be maintained by the Department of Defense. These records are not available to the public. What Military Personnel File Needs to Show — The National Archives Aug 23, 2025 — If a retired service-member has not applied for any military records, he/she may apply for a Military Personnel File (MM) as an attachment to his/her DD-214, which shows his service date, military type, dates of discharge, and any other records. The request form should be attached to a DD-214 or other military records as an attachment on Form 1310-F. What is a Military Personnel File (MMP)? Military Personnel Files (MMS) are available to: Active duty members and military retirees. Former members of the National Guard and Reserve. Federally-recognized Indian tribe members. The MM must be requested and the application completed prior to the end of the first month of employment. The current process is to have a DD-214 filed. The MM will be created based on information provided by the service member and includes the following: a. Name and sex (male or female) b. Home address including state or province of residence if an in-state dependent; the veteran's military pay grade; the veteran's grade and pay grade, and number of years of service c. The date of separation (date of separation) d. Other information necessary to complete the application including the date of the release from Active Duty, and date of discharge from Active Duty a. Discharged or discharged under honorable conditions b.

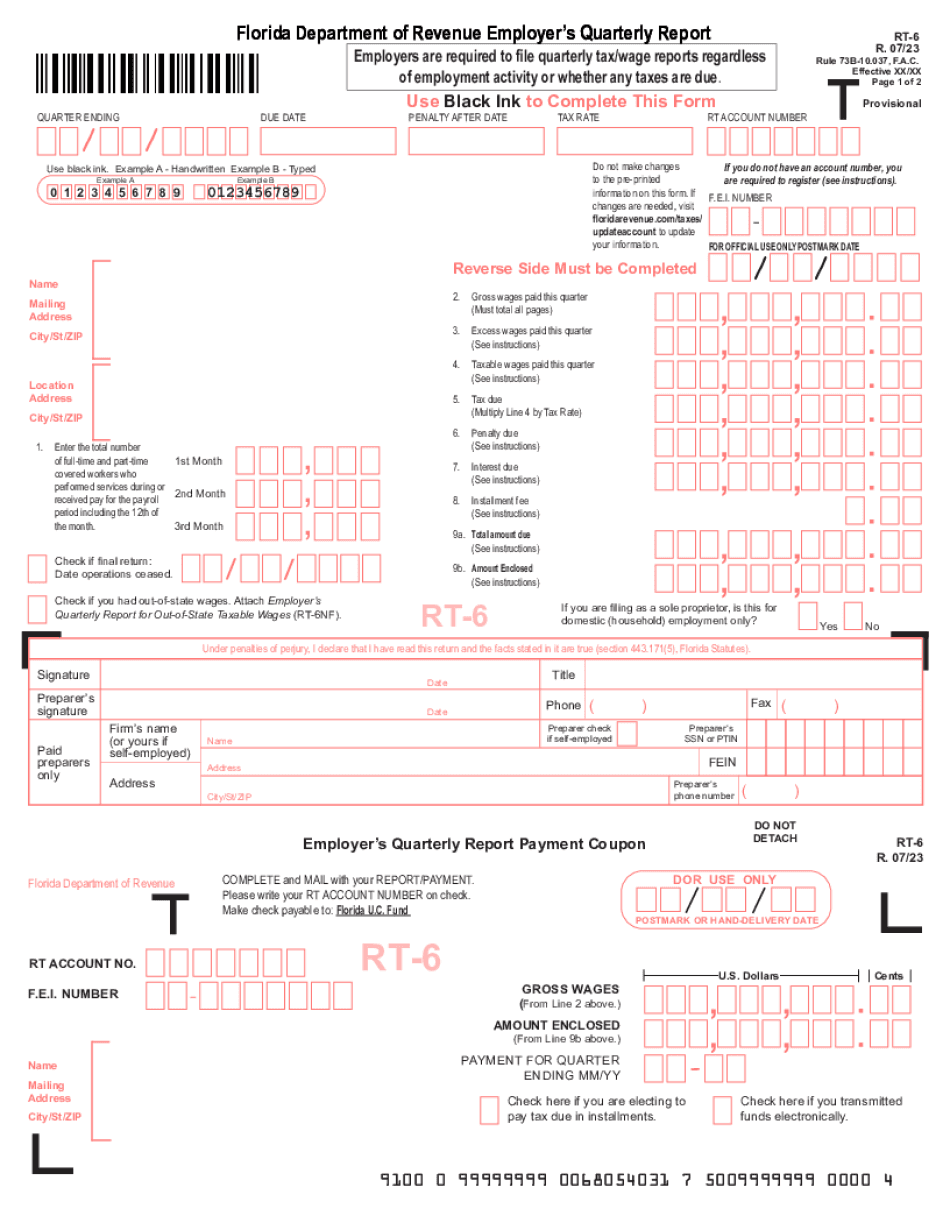

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FL DoR RT-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any FL DoR RT-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FL DoR RT-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FL DoR RT-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.