All right, here we go. Today, we've got an acrylic fill from the set we did last week, which was the Game of Thrones nails. But we're gonna change it up just a little bit, try to get your customer in and out. We're gonna show you all of this in real time. All right, Tres, we've got another real-time set. This one is gonna be a little tricky because you're gonna take those Game of Thrones nails and actually turn them into something. I don't know how you're gonna do that. What do you have in mind? Please explain to us. - Go, so demanding today, always demanding. That is true. I want to know the details. Go. I got one audience member ready. You're lucky! - So a customer is coming in. It has actually been two weeks since she had these nails. She changed a couple of nails here and there, but two weeks, that's pretty impressive. I'm typically just gonna book a 30-minute appointment for my customer. They may want to change it up a little bit, but I'm not gonna be removing a ton of product or doing a ton of things. We might throw some manicure on there, maybe some glitter, maybe some stamping. I'm not sure yet, but we're gonna keep a little bit of the fire and ice, but give her a completely different look. - How much time is this gonna take? If you didn't mention that already, I'm doing a 30-minute appointment. So after 30 minutes, she's getting out of here. Yeah, perfect. I'm excited to see this. Are you ready? Yeah, all right, let's do it. - Okay, let's start by pushing her cuticles. We have actually been to a trade show, messing with a lot of stuff, and then we got the...

Award-winning PDF software

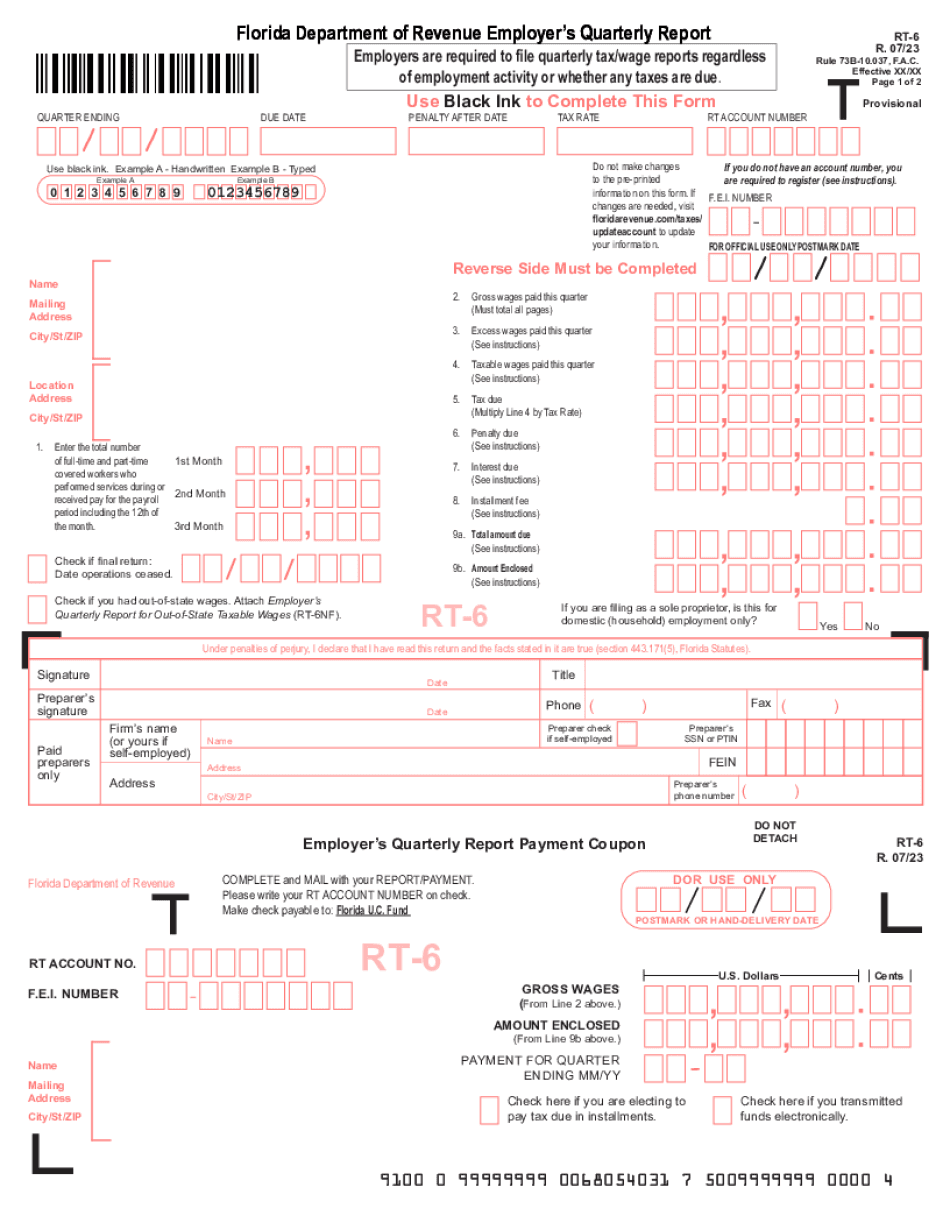

What is rt-6 tax Form: What You Should Know

This report must be filed by the employer on the 15th day of each calendar quarter. The law requires employers to include the gross wages and the amounts paid to non-covered workers in this report.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FL DoR RT-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any FL DoR RT-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FL DoR RT-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FL DoR RT-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is rt-6 tax