Welcome to GTV. Today, I will be showing you ABBS Jakob Safety RT6 safety relays. The RT6 Universal relay supervises both safety devices and the internal safety of machinery. In addition, the safety level required for each installation can be selected with this safety relay. The RT6 has some of the most versatile input option arrangements available on the market, allowing it to replace many other relays. This relay also comes with other options such as manual or automatic reset. Manual supervise reset can be used for gates and other safety devices that can be bypassed. Automatic reset can be used for small hatches if deemed acceptable from the risk assessment. The RT6 also has information outputs that follow the inputs and outputs of the relay. These outputs will, for example, indicate if a gate is open or closed and if the safety relay needs to be reset. They are designed with a minimal amount of components, thus keeping both production costs and component acquisitions to a minimum. Features of the RT6 include five input options and single or dual channel input. There is a test input for supervision of external contactors and an LED indication of supply inputs, outputs, short circuit, and low voltage level. There are also two voltage-free transistor information outputs. Applications for the safety relay include emergency stops, light curtains, three-position devices, interlock gates and hatches, magnetic switches, light themes, safety mat contact strips, and foot-operated switches. A wide range of safety products, including the ABBS Jakob Safety RT6 safety relays, are available at galco.com.

Award-winning PDF software

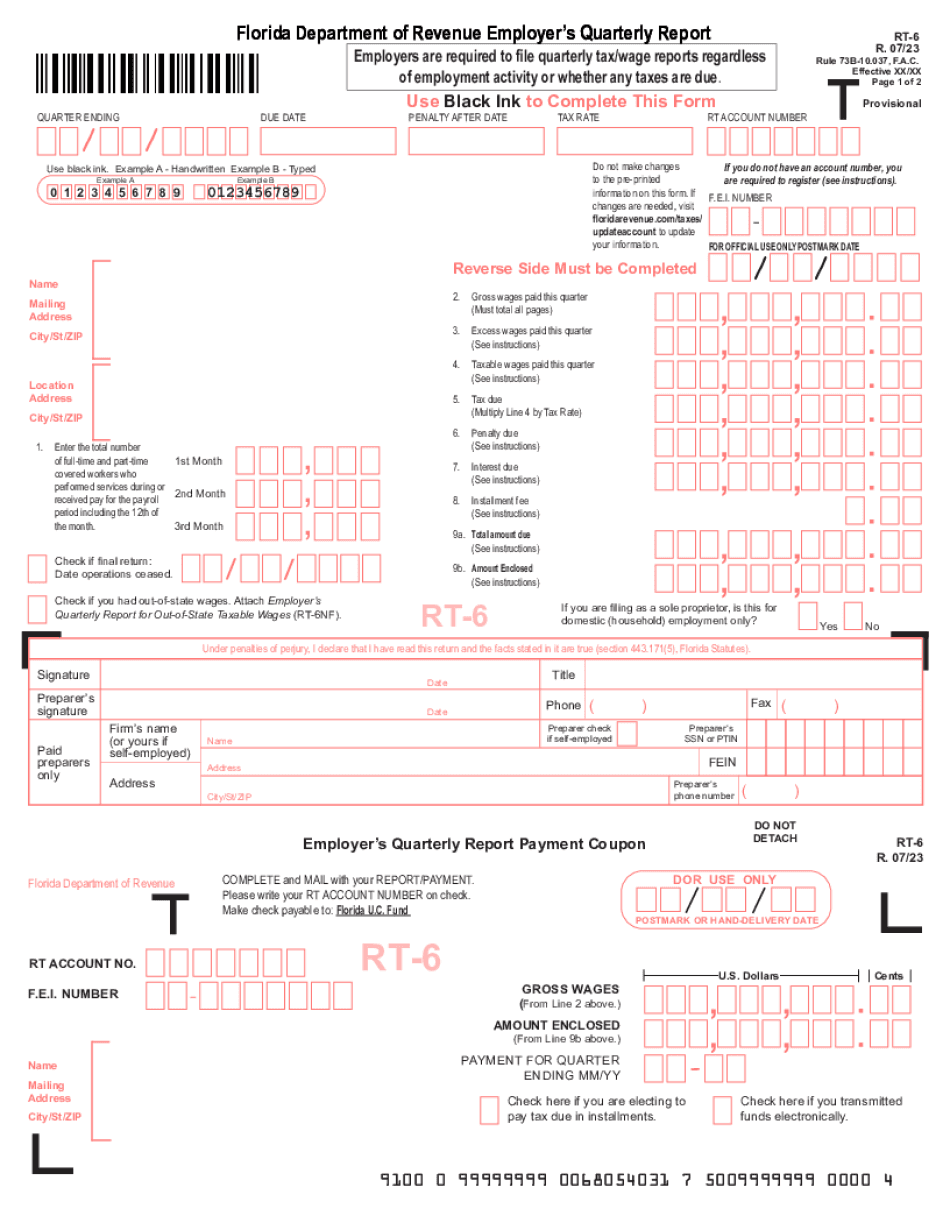

Rt-6 online Form: What You Should Know

For more information or questions call. Employer's Quarterly Report (Form RT-6 PDF Icon) for F-1 and H-1B Non-Citizens The following forms of filing may be required by the employer (other than Forms 1095-B, 1095-C, 1095-E, 1095-PR, 1095-S, 1094-B, 1095-MISC or Form W-2) if both the Florida and the US employers are required to file a separate Florida tax return. The US Employer may send a separate Form W-2 for F-1B Non-Citizens and Form W-2S for H-1B Non-Citizens. An ETA will be sent directly to the FL Employment Service office, if you are requesting an ETA from the FL Employment Service office. If you are filing by the U.S. Employer you may file without an ETA. The F-1 and H-1B employers must file Form 1099-INT (or 1099-X) to report any income from their foreign source in this income tax form. The forms are available at the FL Department of Revenue. If you have filed more than one return or if information is missing from any of the return(s), you can call (86 or visit step.SOS.state.fl.us for filing assistance. For more information about Florida taxes go to FL Dept Of Revenue Web Page. F-1 and H-1B Employer's Quarterly Report & Tax Payment Information The Employer must provide the following information on Form 1099-INT or ETA to the FL Department of Revenue: Employers must complete Form 1099-INT within 28 business days of the close of the prior quarterly pay period. A Form 1099-INT cannot be filed if a timely filed Form 1095-C or the Form 1095-S was filed at the beginning of the quarterly period. A Form 1099-INT cannot be filed if any returns are incomplete, not properly completed or not properly filed. A Form 1099-INT cannot be filed if no quarterly reports were filed.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FL DoR RT-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any FL DoR RT-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FL DoR RT-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FL DoR RT-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Rt-6 online