The Florida Department of Economic Opportunity presents a reemployment assistance application guide to filing a claim. This will make completing the application a piece of cake. Whether you are recently laid off, quit your job, were fired, or had your hours reduced, you can file for reemployment assistance benefits. Reemployment assistance is there to provide you with temporary financial benefits if you lost your job through no fault of your own and meet the eligibility requirements. We encourage you to file your claim right away because reemployment assistance benefits run from Sunday to Saturday. You have until Saturday evening to finish, after which an unfinished application is lost for filing a claim. The general rule of thumb is, if you worked your full regular hours for the week, wait until Sunday to file. If you worked less than your normal week, file immediately. If you're unsure if your situation qualifies for benefits, you should file and allow us to make the determination. Let's begin with the information that you'll need before starting the application. You'll need to have your social security number and your driver's license or other government-issued ID. If you're not a US citizen, you'll also need to provide your alien registration number on the back of the card. We will also need the last 18 months of employment with all employers. You will need to provide the employer's name, their contact information, dates worked, gross earnings, and the reason for separation. Most of this information can be found on your W-2s or pay stubs. If you were in the US military during this period, you will also need to provide your DD-214 member form. If you were a civilian employee with the federal government, you will need to provide your SF-50 as appropriate. You will be given the...

Award-winning PDF software

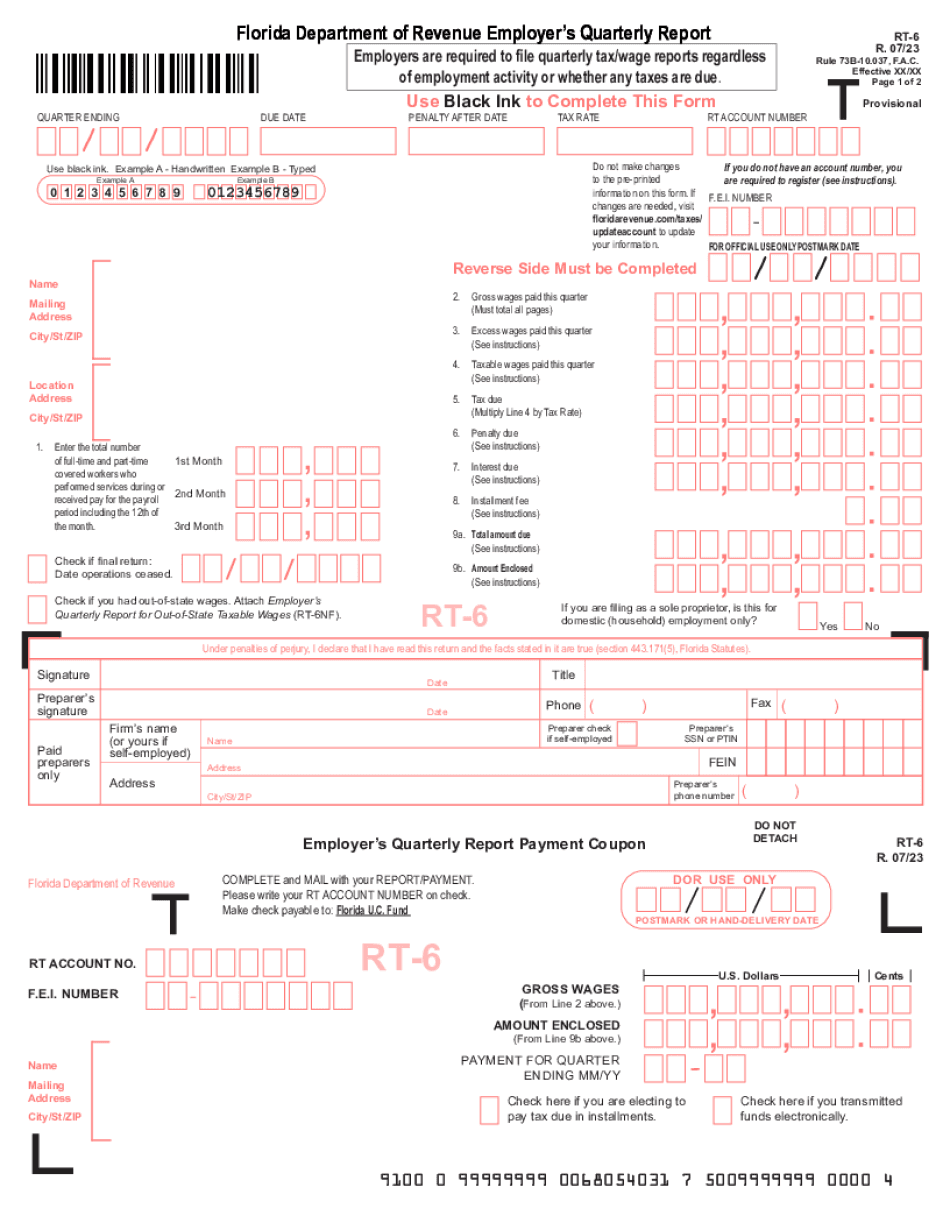

Florida reemployment tax Form: What You Should Know

Affidavit of Support (U.S. Visa) — visas.gov It is used with the Form I-864 to show that the sponsor has financial means to care for the Affidavit of Support (F-1 Visas) — fina.mil/forms/efs.html Affidavit of Support (E-2 Visas) — VISA Affidavit of Support (I-94 Visa) — e-visa.state.gov Affidavit of Support (J-1 Visa) — J-1visas.gov Affidavit of Support (J-2 Visa) — J-2visas.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FL DoR RT-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any FL DoR RT-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FL DoR RT-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FL DoR RT-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida reemployment tax form