Hello guys, this is P from Like My Tech Comm. This is for people in Florida who have recently registered a company in the state. After filing everything, you don't need to send any extra money. However, you might receive a letter a couple of days later from "Florida Certificate Services" with an address. Beware, these are scammers pretending to be official. In the letter, they will ask you to send $61.25 for a Florida curve certificate of services. This is undoubtedly a scam. Sadly, I don't have the time to pursue these scammers legally, but I wanted to create this quick video and mention their name on YouTube, so when people search for them, they know it's a scam. Please do not send any money. When registering in Florida, you already have the option to pay an additional $8 for your certificate to be sent either by mail or digitally. So, do not fall for these scammers. Shame on you scammers for trying to cheat people out of their money. Instead, why don't you find a legitimate job or offer a genuine service to help people? Let's not get scammed, and please be cautious out there. Thank you, and take care.

Award-winning PDF software

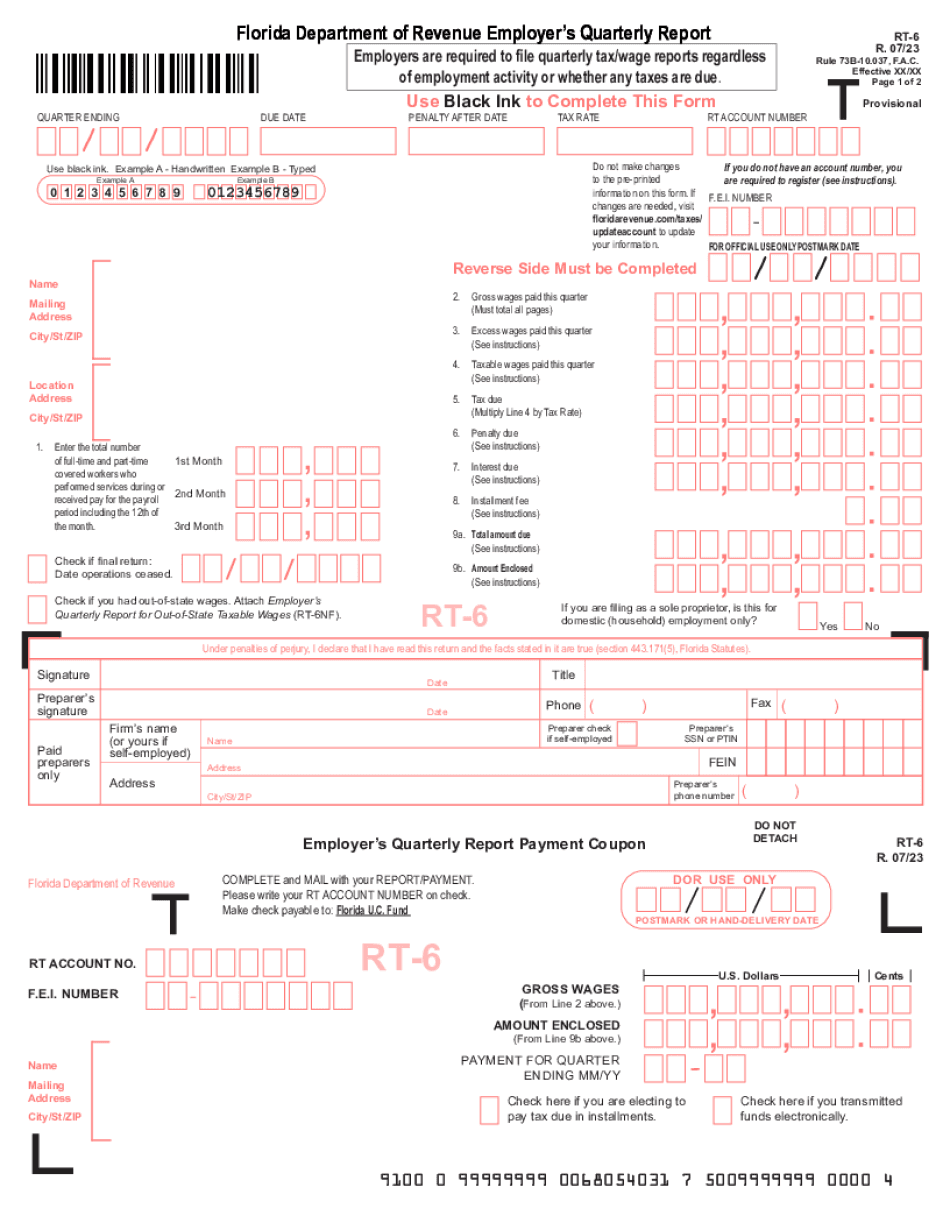

Florida unemployment tax Form: What You Should Know

Where can I get a 1099-R for tax reporting 1099-R Form, is a paper tax form filed by the Internal Revenue Service for state and federal tax return purposes. To request a copy of your 1099-R, please contact the state office where you reside and request an online copy of your 1099-R form. Category: General. Florida Dept. of Revenue 1099-R Receipt Form Is there a state benefit program that requires a W-2 Tax Return but does not require a W-2 Tax Form? Most employment assistance programs do not require a mandatory 1099-W or 1099-R, and some programs and agencies do not require an individual's 1099-R. If you are a Florida taxpayer that is receiving benefits under federal unemployment compensation, social security disability compensation or workers' compensation programs through a federal, state or local agency, and you would like to file a 1099-W or/ 1099-R for tax reporting purposes, you must check the relevant box on the applicable employment assistance form. If the Form 1099-W or 1099-R is not filed due to your failure to check the appropriate box, it will not be accepted. The employment assistance form for this purpose is listed in the following table. If an employee is required to check the box 'yes' under the box, the employee will file with the applicable Florida withholding agency a 1099-W, and all Florida tax reporting and collection obligations, including any federal and state tax returns/returns under the Unemployment Compensation, Social Security Disability and Workers' Compensation laws, will be determined on this 1099-W. In cases where an employee who is a Florida taxpayer is unable to file a 1099-R due to an inability to work, and that is the state agency where the employment assistance is provided to the employee, the employee may file a 1099-R with the state agency providing the employment assistance and all tax reporting and collection obligations, including IRS-Citizenship, will be determined on this 1099-R. The state agency that provides the employment assistance is listed in the following table. Note: When conducting a 1099-R or 1099-W, you will need to check the box 'yes' to indicate for a tax reporting period in which tax-related income is generated by the program administered by the agency.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FL DoR RT-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any FL DoR RT-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FL DoR RT-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FL DoR RT-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida unemployment tax form