Hi, my name is Kjell Edge and we are coming to you live from the tack shop in Port Saint Lucie, Florida. We are located at 932 Southwest Bayshore Boulevard. Thank you for joining us today. The subject of this short video is what you thought you knew about collecting and paying Florida sales tax. Let's go over some of the basics. First of all, the state of Florida imposes a 6% sales tax statewide on purchases for resale. Counties have the option of imposing a surtax over and above the 6% sales tax collected, which goes to the county where the sale occurred. Sales tax has to be collected and paid either monthly or quarterly based on what the state of Florida tells you as an account holder for sales tax. If you are a quarterly payer, let's use an example of the fourth quarter of this past year. Any sales tax collected from October 1st to December 31st has to be reported to the state of Florida by January 20th of the following month. If you're a monthly payer, any sales tax collected between December 1st and December 31st has to be paid by the same due date, January 20th of the following month. In this case, it is January 22, 2019. Sales tax has to be paid electronically and when you do that, you are allowed to take up to a $30 collection allowance on the sales tax that's collected based on the volume of sales that you did for the particular month. The maximum you can take every month is $30. If you don't pay electronically, you are not allowed to take the collection allowance. You have to mail it. If you choose to mail a check in, you are not able to take the collection allowance. Okay, let's...

Award-winning PDF software

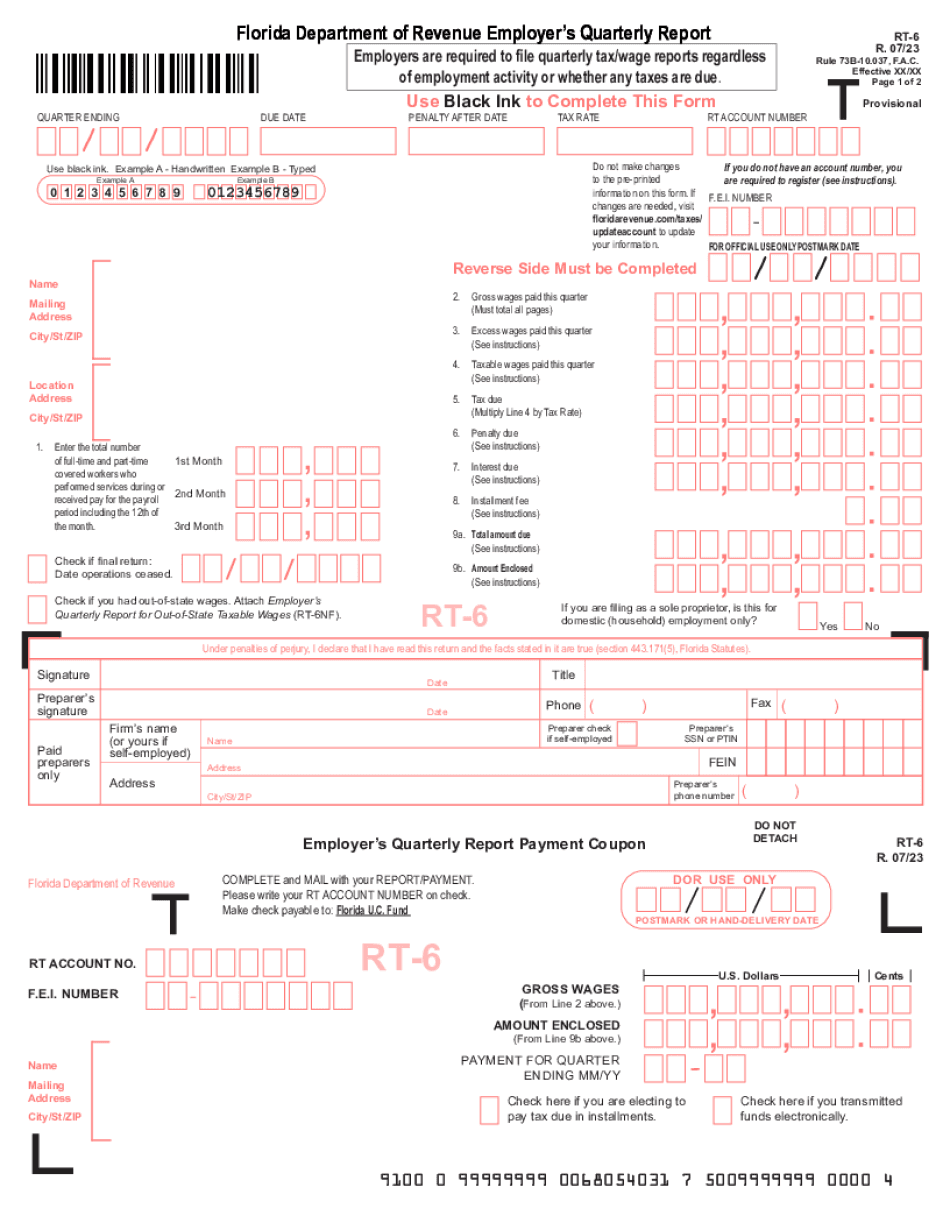

Florida reemployment tax account number Form: What You Should Know

Department at. Note: XXXIX is an optional field to be entered. Reemployment Tax Account Number Reemployment Tax account numbers (Xxx) are assigned for purposes of reporting and receiving the reemployment tax return. Employing entities (individual or businesses) must prepare a Reemployment Tax Return and pay the tax on it. Florida Department of Revenue For more information, see Registering Your Business (Form DR-1 — N PDF Icon) For more information, see “Florida Reemployment Tax: State Tax and Employer License Fees” (PDF Icon) State Department of Revenue Reemployment Tax Form and Instructions The form has the following sections: Employer's Application for a Florida Business License 1. Application for a Florida Business License a. This form is issued to all Florida employers and their officers and employees. b. 1. What is an Employer? An employer is a person who receives money, including wages or other compensation, from a client or customer, or from a grant, donation, or loan, to: i. Design, manufacture, operate, maintain or develop a business; or ii. Make any capital investment in a business. Examples of occupations for which an individual receives compensation from an employer include, but are not limited to, the following: Bakers Grocery men Retail salespersons Golf professionals Hairdressers Professional dancers 2. How do I prepare and file this form? To be eligible to file the form, you must meet the following application requirements: a. You must be an individual or corporation, with an annual gross revenues of six (6) or more a thousand dollars, or a sole proprietorship, and your gross annual receipts for each month of the year do not exceed one-third of the number of months in that year. b. You must have paid the required registration fees. c. Furthermore, you must meet the eligibility requirements, which may depend on your taxable source status, and be a Florida corporation. 3. What are the requirements of an Employer License? You must file Form DR-1 every year, for which you must also file an annual summary return. You must provide a detailed statement for each worker who performs services for the business in Florida. a.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FL DoR RT-6, steer clear of blunders along with furnish it in a timely manner:

How to complete any FL DoR RT-6 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FL DoR RT-6 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FL DoR RT-6 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida reemployment tax account number