P>we got to our tax jar account second we clicked on sales tax report third we're on the Florida report fourth we're on the actual sales tax collected fifth we're on the time period that we're filing for sixth we can see our expected sales tax due report seventh we enter the amount of taxes that were collected eighth we head to the worksheet ninth we finish up with what we have to enter in for data Hey it's mark from tax jar here's a quick video on how to use our Florida tax jar report to file your next sales tax return on the Florida Department of Revenue website, so we've logged into our tax jar account, and we've gone from the dashboard now to click sales tax report seeing the Florida report here we're on the actual sales tax collected, so this is how much we actually collected in sales tax over this time period, so this is going to be the time period that we're filing for we can also before we get started just for to set expectations we can see that we collected three dollars and sixty cents of sales tax let's just see how that compares to what we actually should have collected, so this is our expected sales tax due report, and you can see that we've collected accurately so when we go file the return in Florida we would expect the number to be right around three dollars and sixty cents if not right on this report is super helpful especially if you haven't collected any sales tax or if you're collecting incorrectly all right so let's head on over to our other tab which is open with the Florida Department of Revenue website, so we've already logged in which probably looks pretty...

PDF editing your way

Complete or edit your florida department of revenue anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export my florida department of revenue directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your rt 6 form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your rt 6 fillable form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare FL DoR RT-6

About FL DoR RT-6

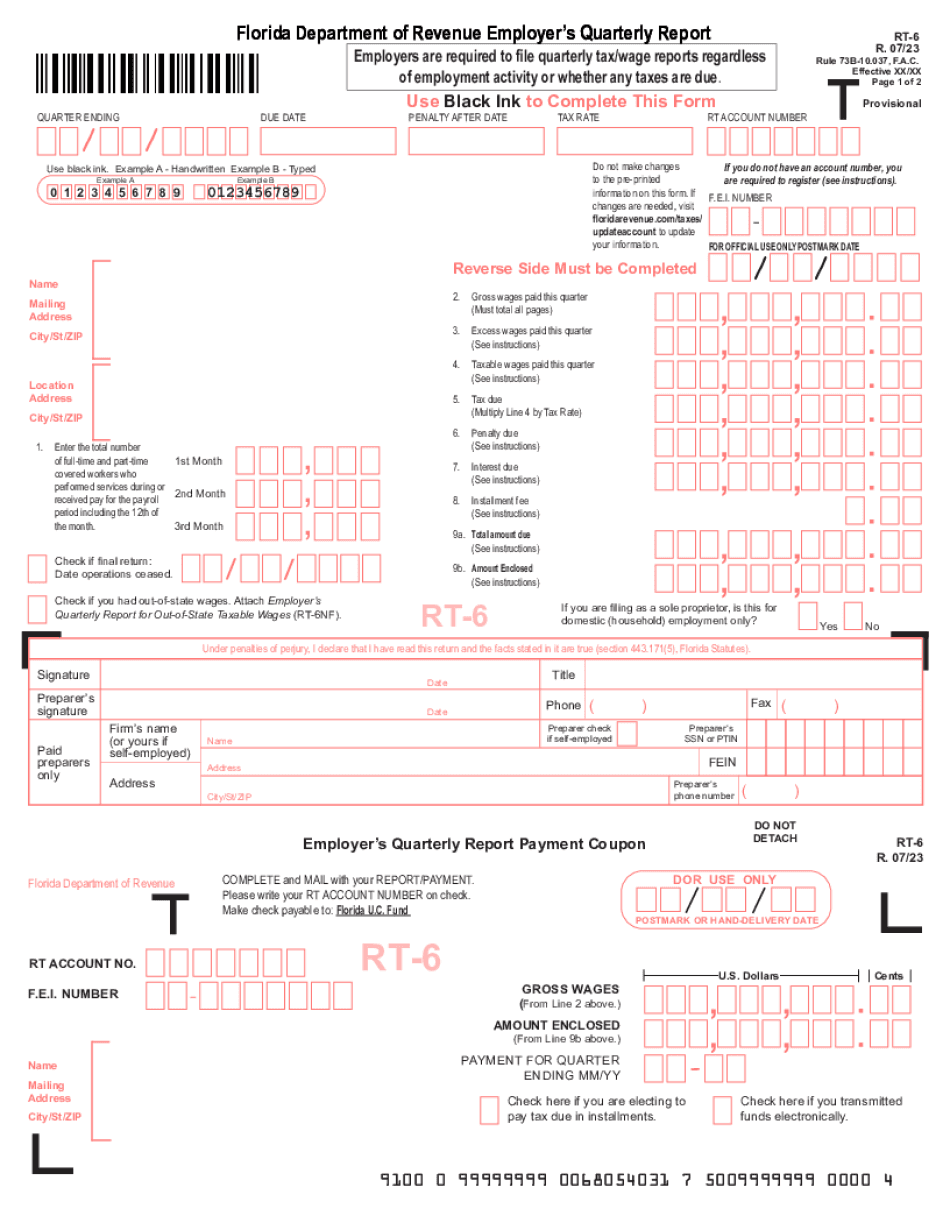

FL DoR RT-6 is a Return Transmittal form used by the Florida Department of Revenue (DoR) for annual Sales and Use Tax Returns. Individuals or businesses that have collected sales tax in Florida must file the RT-6 form to report their sales and use tax collections to the DoR. This form is required for all entities that have Florida sales and use tax certificates or are registered as dealers. The RT-6 form serves as a summary of the sales and use tax return and includes information on the total tax liability, sales amounts, exemptions, and other details. The form must be filed annually, regardless of sales activity, even if no sales tax was collected during the period.

Online solutions make it easier to arrange your file management and enhance the productiveness of the workflow. Look through the quick guideline in an effort to fill out FL For RT-6, stay away from mistakes and furnish it in a timely manner:

How to fill out a Rt6?

-

On the website with the blank, click Start Now and pass for the editor.

-

Use the clues to fill out the relevant fields.

-

Include your personal details and contact information.

-

Make certain you enter true details and numbers in proper fields.

-

Carefully check the data in the form so as grammar and spelling.

-

Refer to Help section when you have any questions or contact our Support staff.

-

Put an electronic signature on the FL For RT-6 printable using the support of Sign Tool.

-

Once document is completed, click Done.

-

Distribute the prepared document by using electronic mail or fax, print it out or save on your device.

PDF editor will allow you to make improvements towards your FL For RT-6 Fill Online from any internet linked gadget, personalize it in keeping with your requirements, sign it electronically and distribute in several means.

What people say about us

File paperwork in time with a reliable online tool

Video instructions and help with filling out and completing FL DoR RT-6